The 2014 Farm Bill provides landowners a one-time opportunity to retain or reallocate the base acres on record for each FSA farm. The current base acres for the FSA farm can be found in the upper block of the FSA letter.

This is not a base acre update, total base acres for the FSA farm will not increase or decrease with this decision. Only the allocation across program crops may change if the landowner chooses to reallocate.

All three programs (ARC-CO, ARC-IC and PLC) pay on base acres and not actual planted acres.

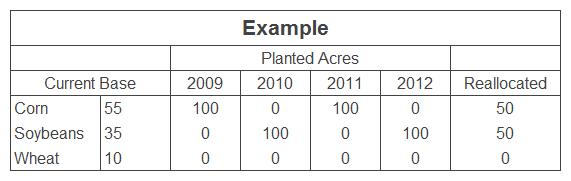

Base acres can be reallocated among program crops on the FSA farm. The optional reallocation is determined by the ratio of acres planted to each program crop as compared to the acreage planted to all program crops on the FSA farm during crop years 2009 to 2012.

This includes any acreage that was prevented from being planted to a covered commodity in a crop year.

No crop year during 2009 to 2012 can be excluded from the calculation.

Generic base acres (former upland cotton base acres) may not be reallocated and must remain in the same amount.

The following is a simple example of the base acre reallocation calculation:

In the above example, the updated program yield of 133 bu/acre would be higher than the current program (CC) yield of 115 bu/acre. The landowner would be advised to update payment yields in this example.

The average yield calculation excludes any crop year in which zero acres were planted to the program crop on that FSA farm.

In general, landowners may want to consider reallocating to better align base acres going forward with current planting decisions or if reallocation will increase the base acres for covered commodities that are more likely to trigger larger program payments over the life of the 2014 Farm Bill.