The 2014 Farm Bill provides landowners a one-time opportunity to update the program or payment yields for each program crop on record for each FSA farm. The current program or payment yield for the FSA farm can be found in the upper block of the FSA letter and labeled “CC yield” (for counter-cyclical yield)

Payment or program yields are used to calculate the payments for the Price Loss Coverage (PLC) program only.

The decision to update payment yields, however, is not limited to only those electing PLC; any farm owner can decide to update payment yields without regard to the program election decision.

If the farm owner decides to update the payment yield, the new payment yield will be calculated as 90 percent of the average yields for the program crop on the FSA farm for the 2008 to 2012 crop years.

The average yield calculation excludes any crop year in which zero acres were planted to the program crop on that FSA farm.

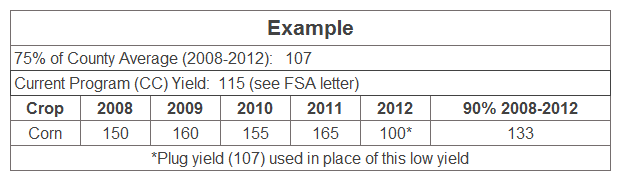

If the yield for the program crop on the FSA farm in any of the 2008 through 2012 crop years is below 75 percent of the county average yield for that crop in those crop years (2008 to 2012), then 75 percent of the county average yield for the crop in those years (2008-2012) will replace that crop year’s low yield (this is generally referred to as a plug yield).

In any crop year where the FSA farm is missing a yield for a program crop that was planted on the FSA farm the above plug yield will be used.

The following serves as a simple example for this decision:

In the above example, the updated program yield of 133 bu/acre would be higher than the current program (CC) yield of 115 bu/acre. The landowner would be advised to update payment yields in this example.

The average yield calculation excludes any crop year in which zero acres were planted to the program crop on that FSA farm.