In August, FSA sent a letter to all landowners and producers of record. This letter is FSA’s record for each of your FSA farms. It provides the following information that you will need for the decision and the APAS decision tool:

FSA farm number(s)

Commodities with base acres on the FSA farm(s)

The amount of base acres for each commodity on the FSA farm(s) as of 2014; in the decision for each FSA farm you can reallocate these base acres across program crops (more information for this decision can be found in step 3)

The program yield on record for each commodity on the FSA farm(s) as of 2014, listed in the letter as the “CC yield” (or counter-cyclical yield); in the decision for each FSA farm you can update the program or payment yields for each program crop individually (more information for this decision can be found in step 4)

FSA’s record of the planting history for the FSA farm(s) for the 2008 through 2012 crop years; this information has been generated from the form (578) filed for the farm certifying what was planted, prevented from being planted, planted as double crop or planted as a subsequent crop. The 2009 to 2012 crop years will be used to help determine the potential reallocation of base acres if you decide to reallocate.

In addition to this letter from FSA, it is recommended that you also have your crop insurance records for each farm on hand as you go through the APAS decision tool. In particular, you will want your yield histories for the 2008 through 2012 crop years.

If you do not have crop insurance records, it is recommended that you have on hand other yield history information. For the payment yield update, the current owner’s self-certification of the 2008 to 2012 yields (subject to spot check or verification) will be accepted.

The 2014 Farm Bill provides landowners a one-time opportunity to update the program or payment yields for each program crop on record for each FSA farm. The current program or payment yield for the FSA farm can be found in the upper block of the FSA letter and labeled “CC yield” (for counter-cyclical yield)

Payment or program yields are used to calculate the payments for the Price Loss Coverage (PLC) program only.

The decision to update payment yields, however, is not limited to only those electing PLC; any farm owner can decide to update payment yields without regard to the program election decision.

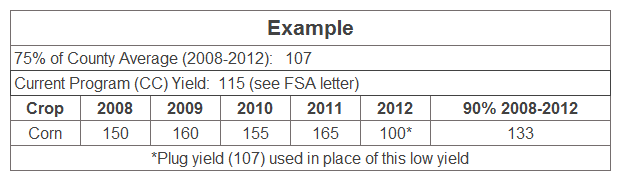

If the farm owner decides to update the payment yield, the new payment yield will be calculated as 90 percent of the average yields for the program crop on the FSA farm for the 2008 to 2012 crop years.

The average yield calculation excludes any crop year in which zero acres were planted to the program crop on that FSA farm.

If the yield for the program crop on the FSA farm in any of the 2008 through 2012 crop years is below 75 percent of the county average yield for that crop in those crop years (2008 to 2012), then 75 percent of the county average yield for the crop in those years (2008-2012) will replace that crop year’s low yield (this is generally referred to as a plug yield).

In any crop year where the FSA farm is missing a yield for a program crop that was planted on the FSA farm the above plug yield will be used.

The following serves as a simple example for this decision:

In the above example, the updated program yield of 133 bu/acre would be higher than the current program (CC) yield of 115 bu/acre. The landowner would be advised to update payment yields in this example.

The average yield calculation excludes any crop year in which zero acres were planted to the program crop on that FSA farm.

The 2014 Farm Bill provides landowners a one-time opportunity to retain or reallocate the base acres on record for each FSA farm. The current base acres for the FSA farm can be found in the upper block of the FSA letter.

This is not a base acre update, total base acres for the FSA farm will not increase or decrease with this decision. Only the allocation across program crops may change if the landowner chooses to reallocate.

All three programs (ARC-CO, ARC-IC and PLC) pay on base acres and not actual planted acres.

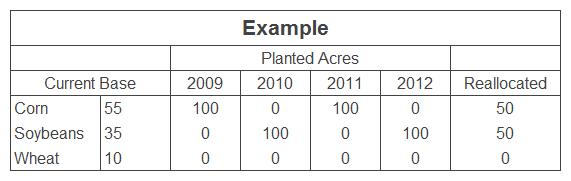

Base acres can be reallocated among program crops on the FSA farm. The optional reallocation is determined by the ratio of acres planted to each program crop as compared to the acreage planted to all program crops on the FSA farm during crop years 2009 to 2012.

This includes any acreage that was prevented from being planted to a covered commodity in a crop year.

No crop year during 2009 to 2012 can be excluded from the calculation.

Generic base acres (former upland cotton base acres) may not be reallocated and must remain in the same amount.

The following is a simple example of the base acre reallocation calculation:

In the above example, the updated program yield of 133 bu/acre would be higher than the current program (CC) yield of 115 bu/acre. The landowner would be advised to update payment yields in this example.

The average yield calculation excludes any crop year in which zero acres were planted to the program crop on that FSA farm.

In general, landowners may want to consider reallocating to better align base acres going forward with current planting decisions or if reallocation will increase the base acres for covered commodities that are more likely to trigger larger program payments over the life of the 2014 Farm Bill.

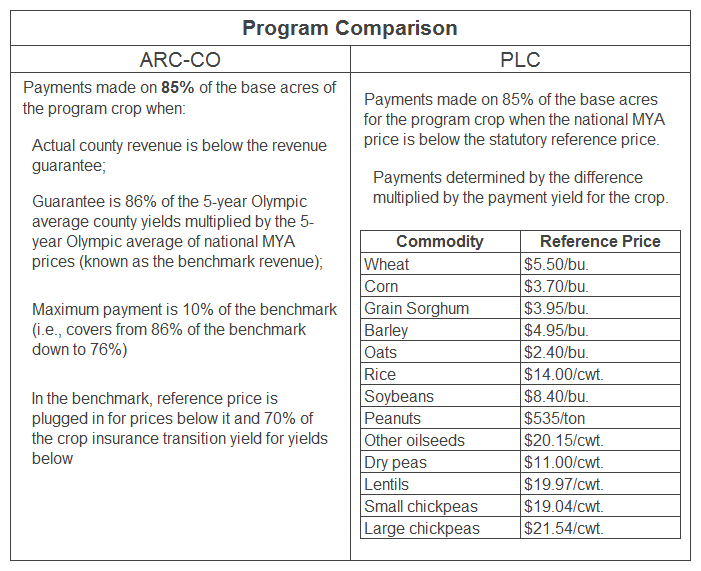

The 2014 Farm Bill provides the producers on the FSA farm a one-time, irrevocable program choice for the farm. The program decision cannot be changed for the life of this farm bill. Step 4 compares the Agriculture Risk Coverage, County Option (ARC-CO) and Price Loss Coverage (PLC) programs.

ARC-CO provides revenue-based assistance using county average yields and national average prices;

PLC provides price-based assistance whenever the national average prices are below a fixed reference price;

Because they are elected on a crop-by-crop basis, it is possible to have both programs on the same FSA farm but for different commodities (e.g., ARC-CO for soybean base and PLC for wheat base).

This decision must be made by the deadline and it must be unanimous by all the producers on the FSA farm. Failure to make the decision by the deadline results in forfeiture of any potential payments for the 2014 crop year and all program crops on the FSA farm are deemed to have elected PLC for the 2015-2018 crop years.

The Market Year Average (MYA) price is the national average price received by producers and calculated by USDA using information from elevators over the 12 months of the market year (e.g., for corn that begins Sept. and ends August the following year).

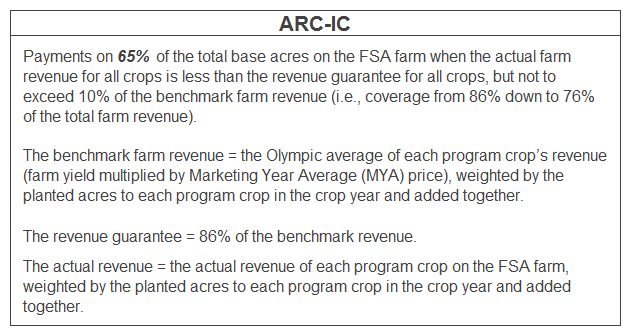

Instead of ARC-CO or PLC (see step 4), the producers on the FSA farm may elect ARC-IC for the FSA farm. The choice of this program, however, applies to all program crops on the FSA farm and cannot be mixed with either PLC or ARC-CO on the FSA farm.

ARC-IC operates on the sum of all program crops on the farm (see below).

ARC-IC calculates the producer’s share of all FSA farms in the state that are also enrolled in ARC-IC.

The actual acres planted to each program crop on the FSA farm in the crop year are used to weight the crop revenues used in the calculations.

Additional notes:

The Marketing Year Average (MYA) price is the national average price for the commodity received by producers in the 12-month marketing year.

An Olympic average involves dropping the year with the highest (yield or price or revenue) and the year with the lowest (yield or price or revenue) and averaging the remaining three years.

For benchmark calculations, any crop year in which the MYA price is lower than the reference price, the reference price replaces the MYA price (plug).

For benchmark calculations, any crop year in which the yield is less than 70% of the crop insurance transitional yield, 70% of the crop insurance transitional yield replaces the yield.

In addition to the program decision, the 2014 Farm Bill also created a new crop insurance program called the Supplemental Coverage Option (SCO) that will be available in certain counties beginning with the 2015 crop year.

SCO is only available for those program crops enrolled in PLC (or not enrolled in any program), it cannot cover any program crops enrolled in ARC-CO and is not available on any FSA farm enrolled in ARC-IC.

SCO is a crop insurance policy for which the Federal government subsidizes 65% of the premium cost of the policy.

SCO provides coverage that triggers payments when actual county revenues or yields fall below 86% of the expected county revenue or yield.

Coverage extends down to the level of the underlying crop insurance policy and within the deductible range for the producer’s underlying crop insurance (i.e., if the underlying policy is 75% revenue protection, SCO provides county revenue coverage from 86% down to 75%).

To be eligible to purchase SCO, the producer must purchase an underlying individual plan of insurance using revenue protection, revenue protection with the harvest price exclusion, or yield protection.

SCO mirrors the underlying crop insurance policy such that if the underlying policy is revenue protection, SCO provides supplemental county revenue coverage.

If the underlying policy is yield protection, SCO provides supplemental county yield coverage.

SCO cannot be purchased to supplement coverage with any other insurance programs.

SCO indemnities are triggered only when a loss is realized at the county level.

The size of the loss at the county level is then used to scale the payment to individual producers based on the total value of their insurance plan’s deductible.

If SCO payments are triggered in a county, all producers in that county who purchased SCO will receive an indemnity, however, the size of those indemnity payments will vary across producers.